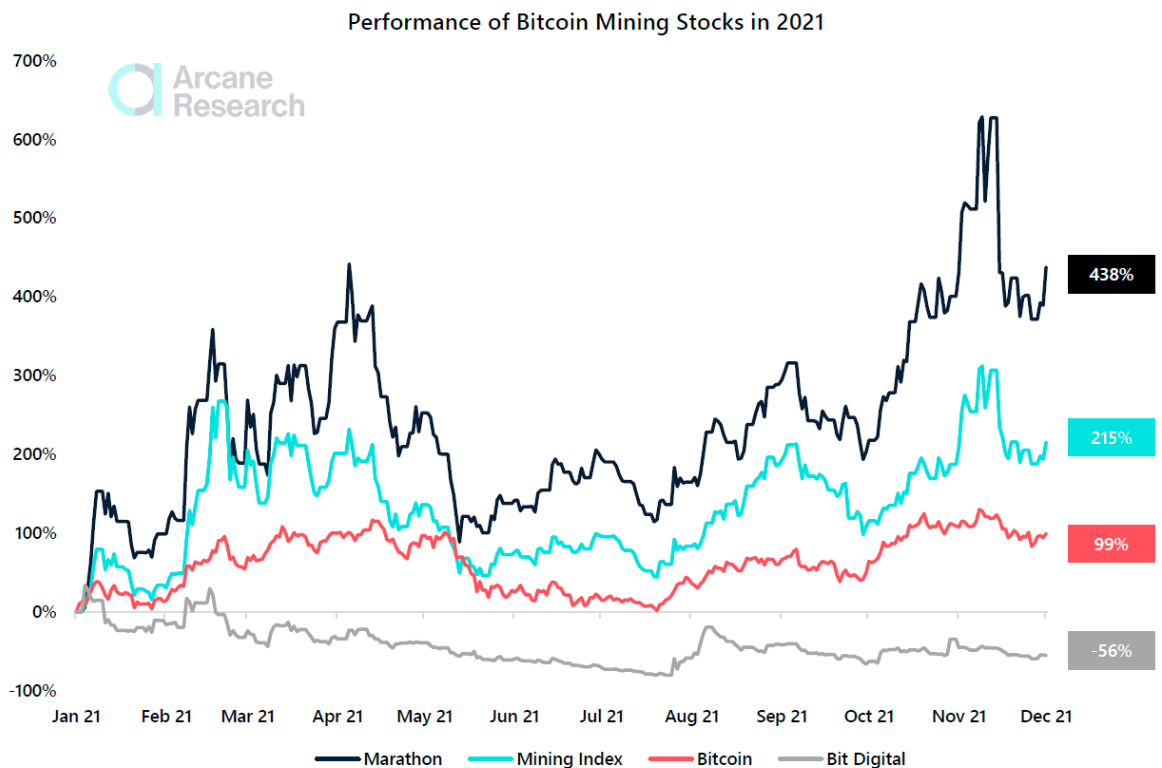

1) Bitcoin mining stocks have outperformed bitcoin in 2021

The mining index has gained 215% so far in 2021, more than twice as much as bitcoin’s 99%. If we go even further back, we see that from January 2020 until now, the bitcoin mining index is up about 1500%, while bitcoin is up 670% over the same period. Naively, we could say that based on this historical data, if bitcoin increases 1%, you can expect mining stocks to gain 2%.Why is it like this? Like all companies, mining companies are valued based on the present value of their future earnings. Since mining companies are risky investments and often 100% financed by equity, their Weighted Average Cost of Capital (WACC) is relatively high. Because of the high WACC, the rising bitcoin price’s immediate effect on a bitcoin miner’s earnings makes the stock price jump. Putting it simply, since an investment in bitcoin mining stocks is riskier than only holding bitcoin, mining stocks should theoretically outperform bitcoin, albeit with higher volatility.One other reason why bitcoin mining companies can outperform bitcoin is, as Nelson Hsieh from Volt Equities eloquently explains in this article, that the profit margins of a bitcoin miner increase at a multiple of bitcoin price increases.Takeaway: Like with all investments, the higher the risk, the higher return you should expect. Bitcoin mining stocks are riskier investments than bitcoin itself, so you should demand a higher return from bitcoin mining stocks than from bitcoin. Also, as you can see on the chart when the bitcoin price falls, mining stocks tend to underperform against bitcoin.2) The performance of the different mining stocks differ greatly

Although the mining index has performed excellently in 2021, the companies composing the index differ significantly in performance. Of the 15 biggest publicly-traded mining companies, Marathon Digital Holdings is the best performer in 2021, with a 438% gain. Marathon invested heavily in new mining rigs at the beginning of 2021 - a bet that paid off as the bitcoin price increased through the year.Also, while some publicly traded mining companies are vertically integrated and own the data centers in which they operate, Marathon rents hosting space for their machines. Not owning data centers allows them to invest all their available capital in mining rigs. Since the value of mining rigs is much more correlated to the bitcoin price than the value of data centers, Marathon's stock is more tied to the bitcoin price than the stocks of vertically integrated mining companies. This strategy is a winning recipe when the bitcoin price increases but can be a double-edged sword in a bear market.On the opposite side of the spectrum sits Bit Digital with its share price down 56% YTD, after spending most of 2021 relocating its operations from China to North America. Relocating a mining operation to the other side of the globe is not cheap, especially with the current supply chain issues. While the transit cost undoubtedly is high, it's not the highest cost of relocating a mining operation. Downtime is a bitcoin miner's worst enemy since the machines are expensive and have limited lifetimes. In 2021, a big part of Bit Digital's mining rigs was in transit or storage, giving them a substantial alternative cost of not producing bitcoin. At the beginning of 2021, Bit Digital's investors didn't consider a lower bitcoin production due to the relocation process. As usual, when a company doesn't meet its expectations, its stock price plummets.Takeaway: Like any other company, a mining company has business risk, and a lot can go wrong - proved by Bit Digital's terrible year. Business risk makes investing in mining stocks riskier than investing directly in bitcoin. A mining investor should create a diversified mining portfolio by investing in several mining stocks instead of just one to reduce this risk.3) Bitcoin mining stocks are highly correlated to the bitcoin price

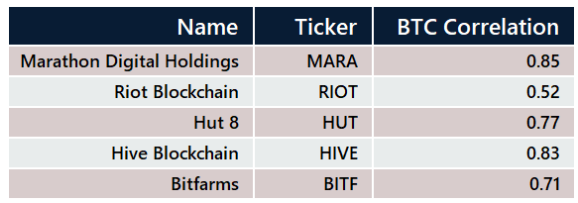

Mining stocks are highly correlated to the bitcoin price. In 2021, the mining index has a correlation to bitcoin of 0.84. As you can see on the chart, the mining index tends to follow the bitcoin price both up and down. Luckily for bitcoin mining investors, the bitcoin price has performed well in 2021, making it a great year for bitcoin mining stocks.

Preview

Preview

4) Bitcoin mining stocks are more volatile than the bitcoin price

As you can see on the chart, the bitcoin mining index has been much more volatile than the bitcoin price. The higher volatility is the reason why it’s outperforming bitcoin. Since they are correlated, the mining index rises by a higher multiple when the bitcoin price increases because of its higher volatility. If you look at the individual mining stocks, like Marathon Digital Holdings and Bit Digital, from the chart, you can see that they are highly volatile. In the last two weeks, as the bitcoin price decreased, Marathon Digital Holdings stock is down almost 30%, so you can see that the higher volatility also applies to the downside.Takeaway: Be prepared for high volatility if you invest in bitcoin mining stocks. But know that volatility and high risk is the reason why these stocks outperform.5) Bitcoin mining stocks get almost all their gains from short periods

Not only are bitcoin mining stocks incredibly volatile, but they get most of their gains over a short duration. Everyone who has been invested in bitcoin for more than a year knows that bitcoin has the same characteristic. The price can lay relatively idle for several months before exploding upwards when least expected. An example of a short period with extreme gains for bitcoin mining stocks was the first eight days of January 2021. The mining index increased 74% during these eight days, and Marathon Digital Holdings' stock gained 140%. Even the most volatile altcoins struggle with bagging such gains in just eight days.Takeaway: It's difficult enough to time the market when investing in bitcoin. Since mining companies get so much of their returns from shorter periods, it is essential to think long-term and not jump in and out of these stocks. If you miss these brief periods of extreme gains, you may miss out on any gains at all.Conclusion

Mining stocks are highly correlated to bitcoin, and investors can therefore utilize them to gain bitcoin exposure without buying bitcoin directly. These stocks are also more volatile than bitcoin, meaning that bitcoin bulls who want to leverage their holdings can purchase mining stocks to supplement their portfolio.Although the mining index has made twice the gains as bitcoin in 2021, it's essential to be aware that an investment in mining companies carries a much higher risk than an investment in bitcoin itself. Bitcoin mining stocks have business risks, which bitcoin doesn't have. These characteristic makes it extremely important to diversify and not just invest in one mining company.The recent focus on bitcoin ETFs has shown us how thirsty the market is for bitcoin investment vehicles. Institutions are increasingly dipping their toes into bitcoin, and investing in mining stocks remains a popular method for them to gain bitcoin exposure without buying the asset directly. Will we see an institutionally driven surge in bitcoin mining stocks in 2022?

Preview